19 Aug

The online world is growing. Your patients currently live online. They shop online, do their banking online, research online and they read peer-reviews of medical practitioners online. Therefore you need to be online. You need to control your own narrative and you need to provide the kind of digital tools patients want and expect.

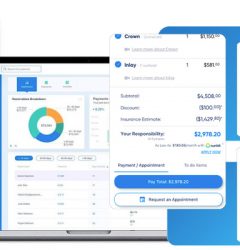

By providing online treatment plans that can be customized to meet a patient’s medical and financial needs, you will create the ideal conditions for the treatment plan acceptance.

Patient as consumer

Your patients are consumers and according to a study by techcrunch.com, 77% of Americans shop online and according to an ABA Banking survey, two-thirds of Americans use digital banking channels most often. The reason for this shift to online shopping and banking is not just for convenience. People shop online for several reasons: to compare prices, to ask questions, read reviews and to get information. Consumers want to feel informed and make decisions that they feel good about.

Right now, the medical world is still light-years behind when it comes to digital access and innovation. The medical world is stuck in a traditional model of phone calls, manual schedule-keeping and paper billing. Most providers have not progressed yet to the digital sphere and it will increasingly hold back their ability to grow their patient-base. Providing digital services to your patients will definitely impress them and demonstrate that you are a forward-thinking provider who is comfortable with change and embracing modern ways of interacting. In fact, according to a Forbes study the healthcare market is now waking up to this reality and the next twelve months will see a significant increase in the digital transformation of healthcare as institutions are more interested in driving down costs and in patient engagement.

Some of the ways that an online presence will enhance your patients’ experience:

- Provide an easy way to make/cancel appointments.

- Access their treatment plans to see what needs to be done now and what can wait.

- Allow your patients to securely sign digital consent forms from anywhere using any device

- Offer financing options with financial partners making it easy for them to see how much each treatment will cost and providing solutions for them to meet their treatment goals.

- Finding relevant information on different conditions, treatments and procedures that will inform their decision-making.

To increase the acceptance of a treatment plan, provide third party financing options.

However, providing your patients with these tools will also simplify your life tremendously and cut-down on hours of paperwork that you would have to otherwise prepare. By empowering your patients and giving them the tools they need to make informed decisions, you will see your rate of plan acceptance rise.

Future-proofing

Another very important reason to move to the digital sphere is the simple fact that younger patients will expect such convenience. Younger patients will be the key driver for this shift to digital. To attract younger patients you will have to be willing to leave the confines of your office space and meet them where they operate – online. If you are able to provide them with the ability to book appointments, find answers to their medical questions, track their health information, read reviews and comments from providers and peers and pay for their services online, then you will gain their trust and their loyalty.

Payment and financing

Medical costs are rising and medical debt is one of the most common reasons for bankruptcy. According to thebalance.com, one million Americans declare bankruptcy due to medical costs every year. Such a staggering statistic is one of the reasons that medical providers need to evolve the way in which treatment costs are handled. By providing online treatment plans that can be customized to meet a patient’s medical and financial needs, you will create the ideal conditions for the treatment plan acceptance.

To increase the acceptance of a treatment plan, provide third party financing options. By partnering with financial providers and providing estimates of treatment plans based on a patient’s insurance verification, you will help them see what different options would cost in real dollars every month. Such a breakdown of their true out-of-pocket expenses will help patients understand what they can afford and by integrating financing partner portals, you will facilitate the transaction for them. It is a more flexible way of showing a patient their options and of being transparent. Zuub is able to do just this and can be customized to reflect the insurers and financial partners you prefer to work with.

The integration of dental financing and payment will benefit both you and your patients. It is a smart way of addressing bad debt expenses – something that affects all practices and hospitals. Digitizing the tracking of unpaid bills will minimize the time office staff must spend tracking unpaid invoices. Instead, digital payment systems can track invoices and payments, send automatic reminders when invoices are due and update billing accounts, which will save hundreds of hours for your office staff every year.

Providing digital tools to your patients is a way to better engage with them, to improve the customer experience and to cut-down on your own costs.

Related Posts

Recent Posts

Join Thousands Of Happy Providers

Start maximizing your revenue today!

26%

Average increase in practice ‘s productivity

- Increase case acceptance

- 350+ payer integrations

- Collect more, faster

- Reduce A/R costs

- Full automation

- Live customer support

Ready to get started?

Your online account setup only takes minutes. If you have questions, contact us at (213) 645-2813

Support Hours:

6 AM to 5PM (PST)